Mojoflower provides Government issue share-ledgers and share-management tools for SMEs powered by Stellar.

The focus is on issuing SME shares and certificates on behalf of governments in tokenized form. The tokenized shares are delivered to Shareholders' wallets following a formal application process. We provide shareholders with tools to manage their shares in the tokenized form, increasing usability and enabling them to use smart contracts with ease. Secured by Stellar, the assets can be managed for the asset's full lifecycle while staying compliant with regulations.

You can see our website here. https://mojoflower.io/

Also below are slides from the SCF submission and a link to the entry.

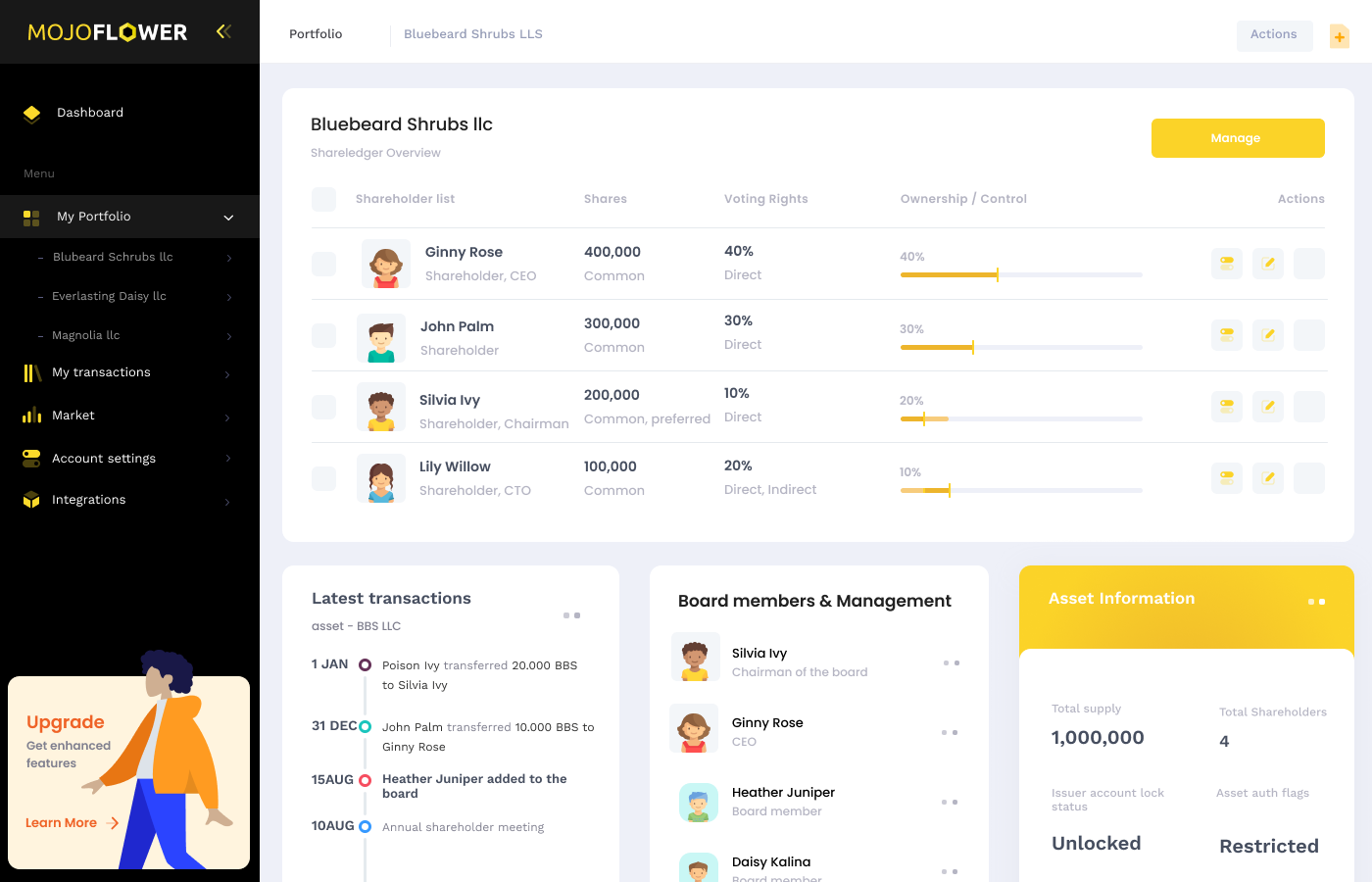

Dashboard

Presentation slides

Introduction

Share-ledgers record ownership of companies, and most often, companies are legally obliged to keep these share-ledgers readily available to all shareholders and Government officials. Share-ledgers constitute the highest legal proof of the ownership – if your name is in the newest version, legally, you are the owner. However, the keepers of share-ledger are not required to adhere to a set standard method, and people can use paper, spreadsheet programs, or dedicated services.

In some areas, such as the EU, Anti Money Laundering laws have increasingly been put in place to increase transparency and make ownership records public with mandatory registration of Beneficial ownership. This registration requires companies to record direct ownership of shares as well as indirect owners, voting rights, and control through related parties.

The different methods people use to maintain records make it hard for the Government to sustain adequate oversight. Governments struggle to keep files up to date and rely on self-reporting from shareholders who see it as tedious and a non-value adding task. The result is a problem that creates inefficiencies that result in both economic and societal costs. These inefficiencies hamper the growth of businesses and make the current system prone to corruption.

A share-ledger system built on Stellar will allow owners to control their shares while keeping the officials updated in real-time without extra effort and receive benefits from keeping their records neat and tidy. Our platform will increase the value and liquidity of shares for the owners and lower government costs.

Background

All private limited liability companies (SMEs) in Iceland are required to do the following:

Register the LLC with the Government registry and get an official ID number. (It's an electronic application process with an Electronic ID as an authenticator for the individuals. Founders are listed, board members, etc.)

When the application is approved, the company is required by law to establish a "Share-ledger." The share-ledger is a record of shareholders and the number of shares they own. For each newly founded company, the share-ledger includes much of the same information as "1)". The share-ledger constitutes the legal authority on ownership. (Majority uses excel. Meanwhile, many do not keep one.)

LLC's are required by law to update and inform the Government registry on changes in ownership due to the beneficial ownership legislation under recommendation from FATF and EU legislation. (This is an electronic process, initiated by logging into a government portal with an electronic ID)

The problem is this. Reporting in compliance and personal record-keeping are independent processes. Compliance relies on self-reporting and self-verification of ownership that can lead multiple versions of "truths" to co-exist at any given time.

Focusing on each group independently, Government, and shareholders, respectively, we can identify issues better.

The situation facing the Government

- The Government relies on self-reporting, and legally there is a window of 2 weeks to inform the Government of change. Documents can easily be backdated and fixed.

- The beneficial ownership reporting is time-consuming and takes some effort. As it provides little benefit to companies, other than being compliant, the risk is that records are not kept well and up to date.

- The records that the Government keep are not the highest authority - it's simply the last known report. It's always the Share-ledger that has the final say.

The situation facing shareholders

- The reporting is a non-value adding task and extra work. There is no real benefit to companies other than being compliant.

- The share-ledger system is currently "self-verifying." By that, we mean that it's the company's representatives that verify its correctness at any given time, and no external party needs to validate this.

- Transfer of shares is not transparent – buyers and sellers need to enforce the share-ledger's update and verify the correctness themselves. Often this includes going through gatekeepers.

- The "Self verification" of the share-ledger decreases the value of the company in multiple ways. There are transparency issues and hidden costs, making it harder for financial institutions and investors to engage with the assets actively.

The current system increases burdens on good actors and favors bad actors. It's extra work for the diligent one, yet it's easy to maintain sloppy or wrong records on the side.

The opportunity and vision

We at Mojoflower believe that blockchain technology can help this situation described above. With new technology and vision, we can unlock value for parties involved, making the whole system more efficient, effective, and valuable.

The new process looks like this

Register the company via the electronic process it's currently done.

Registered data from the Government database is ingested into our systems and shares tokenized as verified assets.

Custody is given to the LLC's owners through the platform, enabling them to unlock value at low cost since verified assets are more valuable.

The result

- For Government, self-reporting becomes automatic reporting and more correct in almost real-time with better results.

- For Shareholders, self-verified assets become officially verified and thus more valuable and more tools to harvest that value.

- 3rd Parties, Investors, FI, and service providers can better interact with verified assets and ensure that the underlying asset's process is compliant and transparent.

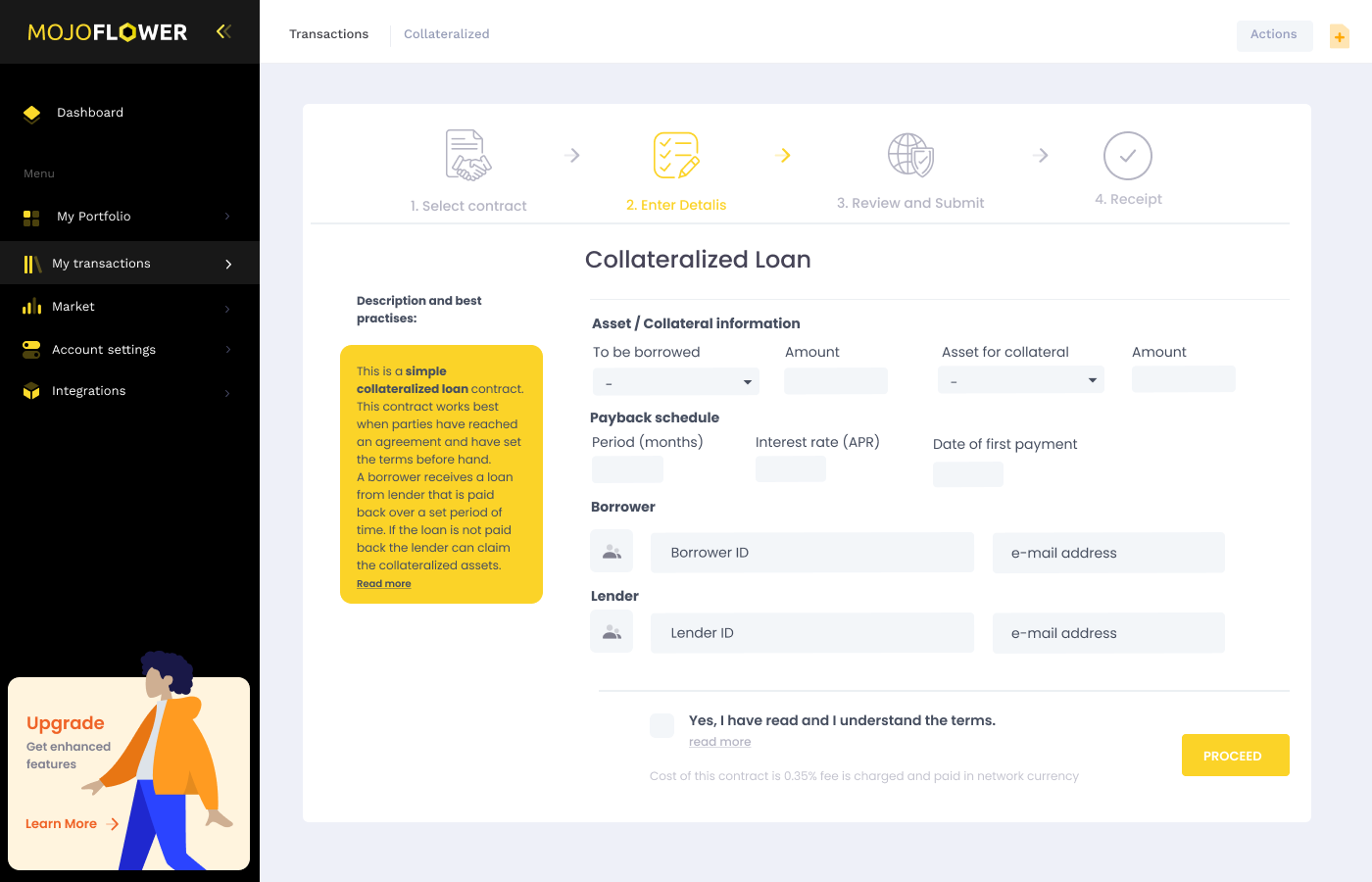

Smart Contracts

Utilizing Stellar's Smart Contract logic, we can build powerful tools that our users can simply interact with. This is what we mean by saying. "We make smart contracts. Simple ".

- Our Smart contracts will enable users to interact with assets more freely and at low costs than before.

- Our Smart contracts include simple transfers, pledging contracts, dividend payments, and more.

- We envision our Smart Contracts being integrated with other wallet and service providers in a reciprocal relationship.

Vision and goals

Our mission is to enable simple share management for SMEs and unlock value for companies while staying compliant.

Our vision is to become the standard for share issuance and share-ledger management and Government issue for company share registration.

Our Values

- We are inclusive and non-discriminative

- We believe in equal pay for equal work and closing the gender gap is our responsibility.

- We believe in equal access, fair pricing of products, services.

- We believe in reciprocal relationships between suppliers and customers.

Benefits for Stellar and the ecosystem

We believe that the success of Mojoflower can trigger a significant adoption event.

Stellar has the opportunity to onboard assets and introduce new users to the ecosystem. With new assets secured by the network and new use cases, undiscovered needs will come to light and drive demand. This demand will positively spiral across the ecosystem.

In the case of Iceland, 40K companies are onboarded. These are all companies where the majority is underserved, yet they are the foundation of the economy. All these companies and their representatives and investors would have direct access to the Stellar ledger. What effect might that have?

One scenario imaginable is that Investors might prefer to invest in companies that pay dividends directly on the network. That would drive demand for anchors and provide foundational support.

Direct access to the ledger and familiarity with the network increases trust and reduces traditional platforms' switching costs. Thus, it becomes easier for product and service providers to introduce their products.

We will develop and facilitate the development of Stellar tools for an inclusive ecosystem. Our tools will include transaction builders, smart contracts, and analytics tools. Independent 3rd party developers or companies can easily interact and integrate with our platform. After all, it's built on Stellar, and stellar is inclusive! We will foster a competition-friendly marketplace, where the user benefit and security will be the focus.

We further see opportunities opening for anchors, wallet providers, financial institutions, Traditional CSDs, or a new type of DSDs, B2B payment providers, B2C-POS solutions, analytics providers, contract builders, and more. We believe in the Stellar vision, technology, governance, and the SDF's focus on a relationship with regulators. We believe in the project and its ability to be a great business opportunity and positively affect society and other businesses.

We believe Stellar is the right choice for the future, and we hope the community will choose us.

The project would utilize

- Stellar

- Existing official Electronic ID system (KYC)

- Existing Government's electronic application process

- Existing banking infrastructure and Stellar anchors

For the full presentation look here -> https://communityfund.stellar.org/seed-fund#/entry/43f6419321e61c9abc7c1abe899b62293c1a9fe7c381e5684af091b1de939579!

If you have any questions, please share and we'll respond promptly.